Empowering Businesses: The Ultimate Guide to Company Tax Planning in 2024

4 out of 5

| Language | : | English |

| File size | : | 1193 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 156 pages |

| Lending | : | Enabled |

Navigating the ever-changing landscape of tax regulations can be a daunting task for any business. The Company Tax Planning Handbook 2024, part of the renowned 2024 Tax Planning Series, provides an indispensable roadmap for companies seeking to optimize their tax liability and maximize their financial performance.

Unraveling Complex Tax Laws

Written by a team of experienced tax professionals, this comprehensive handbook delves into the intricacies of company tax planning. It offers a deep understanding of the latest tax laws and regulations, empowering businesses to make informed decisions that align with their financial objectives.

From understanding the fundamental principles of corporate taxation to mastering complex provisions, the handbook provides a thorough exploration of:

- Taxable income and deductions

- Capital gains and losses

- Dividend distributions

- Tax credits and incentives

Strategic Planning for Tax Optimization

Beyond providing a solid foundation in tax principles, the Company Tax Planning Handbook 2024 equips businesses with practical strategies to optimize their tax position. It reveals innovative techniques for:

- Minimizing taxable income

- Maximizing deductions and credits

- Structuring business operations for tax efficiency

- Managing tax audits and disputes

Industry-Specific Insights

Recognizing the unique challenges faced by businesses in different industries, the handbook provides tailored guidance for:

- Technology companies

- Manufacturing companies

- Retail and distribution companies

- Service providers

Practical Case Studies and Examples

To reinforce the concepts presented, the handbook includes real-world case studies and illustrative examples. These practical applications demonstrate how companies have successfully implemented tax planning strategies to reduce their tax burden and drive financial growth.

Stay Ahead of the Curve

In the rapidly evolving tax landscape, staying informed is crucial. The Company Tax Planning Handbook 2024 provides regular updates and insights to keep businesses abreast of the latest regulatory changes and best practices. With this invaluable resource, companies can stay ahead of the curve and navigate tax regulations with confidence.

The Company Tax Planning Handbook 2024 is an essential tool for businesses seeking to excel in tax planning. Its comprehensive coverage, practical strategies, and industry-specific insights empower companies to optimize their tax liability and achieve their financial goals. By investing in this comprehensive guide, businesses can unlock the knowledge and strategies to navigate the complexities of tax regulations and maximize their financial performance.

Free Download your copy today and embark on a journey towards tax optimization and business success.

4 out of 5

| Language | : | English |

| File size | : | 1193 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 156 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

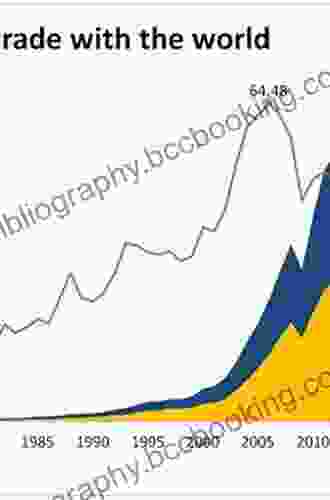

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Iman Hami

Iman Hami Penguin Young Readers

Penguin Young Readers Kenny Ranen

Kenny Ranen Ira Jones

Ira Jones Julie Schoen

Julie Schoen Inc Complex Media

Inc Complex Media Ian Macdonald

Ian Macdonald Tovar Cerulli

Tovar Cerulli James Kaiser

James Kaiser Humberto G Garcia

Humberto G Garcia Remo Guerrini

Remo Guerrini J B West

J B West J Rishi Dadhichi

J Rishi Dadhichi J B Bobo

J B Bobo Thomas Thompson

Thomas Thompson J Franklin Snyder

J Franklin Snyder Ian Boothby

Ian Boothby Isao Honda

Isao Honda Instawise Books

Instawise Books Margaret Randall

Margaret Randall

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

José MartíCool Cat Projects: Pet Projects: The Ultimate Guide to DIY Projects for Your...

José MartíCool Cat Projects: Pet Projects: The Ultimate Guide to DIY Projects for Your...

Oliver FosterDiscover the Riveting World of In Death with Born In Death, the Thrilling...

Oliver FosterDiscover the Riveting World of In Death with Born In Death, the Thrilling... Clarence MitchellFollow ·14k

Clarence MitchellFollow ·14k Brenton CoxFollow ·2.3k

Brenton CoxFollow ·2.3k Junot DíazFollow ·10.6k

Junot DíazFollow ·10.6k Allen ParkerFollow ·19.4k

Allen ParkerFollow ·19.4k Jamie BellFollow ·19.4k

Jamie BellFollow ·19.4k Christian BarnesFollow ·11.9k

Christian BarnesFollow ·11.9k Chance FosterFollow ·19k

Chance FosterFollow ·19k Bradley DixonFollow ·13.7k

Bradley DixonFollow ·13.7k

Luke Blair

Luke Blair101 Amazing Facts About Australia: A Journey Through the...

A Literary Expedition Unveiling the Treasures...

Harry Hayes

Harry HayesWitness the Velocity and Legacy of the Scarlet Speedster:...

Delve into the Lightning-Charged...

Stan Ward

Stan Ward101 Amazing Facts About Ancient Egypt: Unraveling the...

: A Timeless Realm of Wonder Ancient Egypt, a...

Stephen King

Stephen KingEscape into Adventure: Unveil the Secrets of Adventure...

In the annals of comic book history,...

Forrest Blair

Forrest BlairThe Oxford Dog Training Company Presents: A Holistic...

In the realm of dog...

4 out of 5

| Language | : | English |

| File size | : | 1193 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 156 pages |

| Lending | : | Enabled |