How to Tax Economic Rents and Why Your Economic Survival Depends On It

In the tapestry of our economic landscape, the concept of economic rents weaves a complex and often contentious thread. These rents, defined as the returns that exceed the essential costs of producing goods or services, lie at the heart of many of the challenges our societies face today. From soaring inequality to stagnant wages, an understanding of economic rents and the need for a tax system that addresses them is crucial for our collective economic survival.

4 out of 5

| Language | : | English |

| File size | : | 1179 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 108 pages |

| Lending | : | Enabled |

Understanding Economic Rents: A Path to Equitable Growth

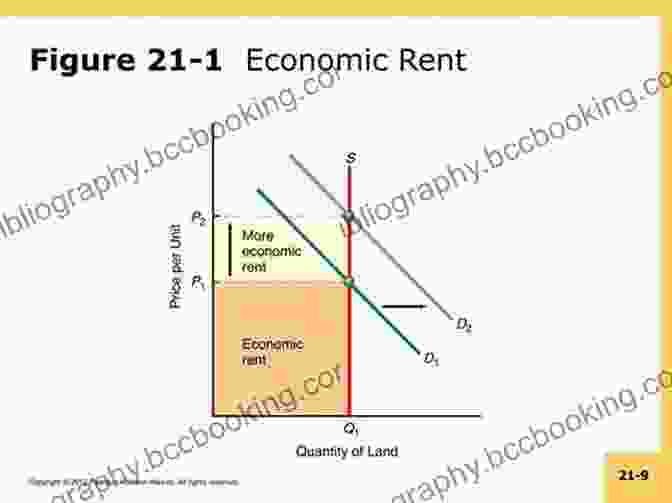

Imagine a scenario where a landowner possesses a prime piece of real estate in a rapidly growing city. The value of the land skyrockets, not because of any effort or investment by the owner, but solely due to the increasing demand for urban living. The landowner, without lifting a finger, reaps substantial profits from this unearned value appreciation. This windfall gain, known as economic rent, is a classic example of a return that exceeds the necessary costs of providing land.

Economic rents are not limited to landownership. They can arise in any industry where barriers to entry or other factors create scarcity and limit competition. These rents can manifest in various forms, such as patent monopolies, regulatory protection, or favorable geographic locations. While innovation and risk-taking should be rewarded, excessive economic rents can distort markets, stifle competition, and lead to a skewed distribution of wealth.

The accumulation of economic rents in the hands of a few can have profound implications for the broader economy. By capturing a disproportionate share of societal wealth, economic rents can exacerbate inequality, reduce economic mobility, and hinder innovation. In extreme cases, they can even lead to economic stagnation and social unrest.

The Imperative for a Tax on Economic Rents

Recognizing the corrosive effects of economic rents, policymakers and economists have long advocated for tax policies that capture these unearned gains. Such taxes serve multiple purposes:

- Reduce Inequality: By taxing economic rents, governments can redistribute wealth, reducing the gap between the haves and have-nots. This can improve economic mobility, create a more equitable society, and foster social cohesion.

- Promote Competition: Taxing economic rents can level the playing field for businesses, reducing the advantages enjoyed by those with windfall gains. This encourages competition, innovation, and the efficient allocation of resources.

- Generate Revenue: Taxes on economic rents can provide a substantial source of revenue for governments. This revenue can be used to fund essential public services, such as healthcare, education, infrastructure, and environmental protection.

A variety of tax instruments can be employed to capture economic rents, including wealth taxes, land value taxes, resource rent taxes, and windfall profit taxes. The specific design and implementation of these taxes will vary depending on the economic and political context. However, the fundamental principle remains the same: tax policies should be structured to ensure that those who benefit from unearned gains contribute their fair share to society.

Case Studies: Lessons from Around the Globe

The implementation of taxes on economic rents has been explored and experimented with in various countries worldwide. Some notable examples include:

- Norway: Norway has a long history of taxing economic rents from its oil and gas industry. This revenue has been invested in a sovereign wealth fund, which has benefited all Norwegian citizens.

- Singapore: Singapore has a land value tax that captures the economic rents associated with land ownership. This tax has helped to moderate housing prices and generate revenue for public infrastructure.

- Pittsburgh, USA: The city of Pittsburgh introduced a graduated real estate transfer tax that targets speculative transactions and helps to prevent excessive land value appreciation.

These case studies demonstrate that taxing economic rents is not merely a theoretical concept but a practical policy tool that can yield tangible benefits for societies. By drawing inspiration from successful examples, other jurisdictions can design and implement their own rent-taxing policies to address their unique economic challenges.

: Embracing a Future of Shared Prosperity

The economic landscape of the 21st century presents us with both opportunities and challenges. Economic rents, if left unchecked, can undermine our economic stability and social fabric. However, by embracing the principles of rent taxation, we can create a more equitable, competitive, and sustainable economy.

The choice before us is clear: we can either allow economic rents to exacerbate inequality and stifle economic growth, or we can tax them and use that revenue to build a better future for all. By choosing the path of rent taxation, we can ensure that our economic survival is not just a matter of survival, but a path to shared prosperity for generations to come.

The book "How To Tax Economic Rents And Why Your Economic Survival Depends On Introducing It" delves deeper into the complexities of economic rents and the urgent need for rent-taxing policies. This comprehensive guide explores the economic, social, and political implications of economic rents, providing policymakers, economists, and citizens alike with a roadmap to a more just and sustainable future.

Free Download your copy today and join the movement to tax economic rents and ensure the economic survival of our societies.

4 out of 5

| Language | : | English |

| File size | : | 1179 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 108 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Lally Brown

Lally Brown Kingsley M Bray

Kingsley M Bray Simon Garfield

Simon Garfield Irvin B Tucker

Irvin B Tucker J D Pham

J D Pham William F Buckley

William F Buckley Iola Reneau

Iola Reneau Iain Gately

Iain Gately Lee H Whittlesey

Lee H Whittlesey Tom Santopietro

Tom Santopietro Instawise Books

Instawise Books Sara El Sayed

Sara El Sayed Huguette Conilh

Huguette Conilh Ian Blakemore

Ian Blakemore Pierre Schlag

Pierre Schlag Ian Ross Robertson

Ian Ross Robertson Jeremy Ford

Jeremy Ford Jared Chapman

Jared Chapman J Michael Leger

J Michael Leger Ina L Yalof

Ina L Yalof

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Sean TurnerUnveiling the Hidden Treasure: A Captivating Journey with "The Lion Who Saw...

Sean TurnerUnveiling the Hidden Treasure: A Captivating Journey with "The Lion Who Saw... Hassan CoxFollow ·9.4k

Hassan CoxFollow ·9.4k Ricky BellFollow ·19.2k

Ricky BellFollow ·19.2k Mario BenedettiFollow ·7.6k

Mario BenedettiFollow ·7.6k Felipe BlairFollow ·3.6k

Felipe BlairFollow ·3.6k Henry David ThoreauFollow ·18.7k

Henry David ThoreauFollow ·18.7k Robert Louis StevensonFollow ·18.9k

Robert Louis StevensonFollow ·18.9k Banana YoshimotoFollow ·3.6k

Banana YoshimotoFollow ·3.6k Douglas FosterFollow ·17.9k

Douglas FosterFollow ·17.9k

Luke Blair

Luke Blair101 Amazing Facts About Australia: A Journey Through the...

A Literary Expedition Unveiling the Treasures...

Harry Hayes

Harry HayesWitness the Velocity and Legacy of the Scarlet Speedster:...

Delve into the Lightning-Charged...

Stan Ward

Stan Ward101 Amazing Facts About Ancient Egypt: Unraveling the...

: A Timeless Realm of Wonder Ancient Egypt, a...

Stephen King

Stephen KingEscape into Adventure: Unveil the Secrets of Adventure...

In the annals of comic book history,...

Forrest Blair

Forrest BlairThe Oxford Dog Training Company Presents: A Holistic...

In the realm of dog...

4 out of 5

| Language | : | English |

| File size | : | 1179 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 108 pages |

| Lending | : | Enabled |